[CAPTION]Team Lightspeed: (standing, from left) Dev Khare, India partner, Bejul Somaia, global partner, Rahul Taneja and Shuvi Shrivastava, India partners; (sitting) Harsha Kumar and Hemant Mohapatra, India partners

Image: Mexy Xavier[/CAPTION]

It was in March 2023 when Prashant Warier, co-founder of artificial intelligence (AI)-powered healthtech startup Qure.ai, met venture capital (VC) firm Lightspeed India Partners’ senior associate Shreyam Desai at a portfolio-investor event, Lift Off, hosted by Lightspeed. Conversations continued for a year, leading to a meeting with Lightspeed India’s partner Dev Khare and the team.

Warier—whose Qure.ai touches over 12 million lives across 90 countries—answered some hard questions on their technology adoption, commercial use cases, global market approach, competition and the stickiness of its customers. Qure.ai works with leading giants AstraZeneca and Medtronic in the medical space.

AI solutions for quicker diagnosis

After completion of rigorous due diligence, Lightspeed India and 360ONE Asset have led a $65 million Series D fundraise for Qure.ai. Merck Global Health Innovation Fund, Kae Capital, Novo Holdings, Health Quad and TeamFund also participated in the fund raise. Investors are betting on Qure.ai’s multimodal AI to help improve early detections in diseases such as lung cancer and tuberculosis (TB).

“The fresh investment tells us that we have a really solid story around AI,” Warier tells Forbes India. Qure.ai processes globally 12 million scans a year, of which five million are TB related, and around three million are lung cancer related. It has a hub-and-spoke model where, through a mobile app, the patient comes to the spoke hospital, gets a scan done and after AI processes the CT scan in less than a minute, the hub hospital is alerted about the diagnosis. Doctors at both the hub and the spoke coordinate to ensure the patient receives the diagnosis and treatment much faster.

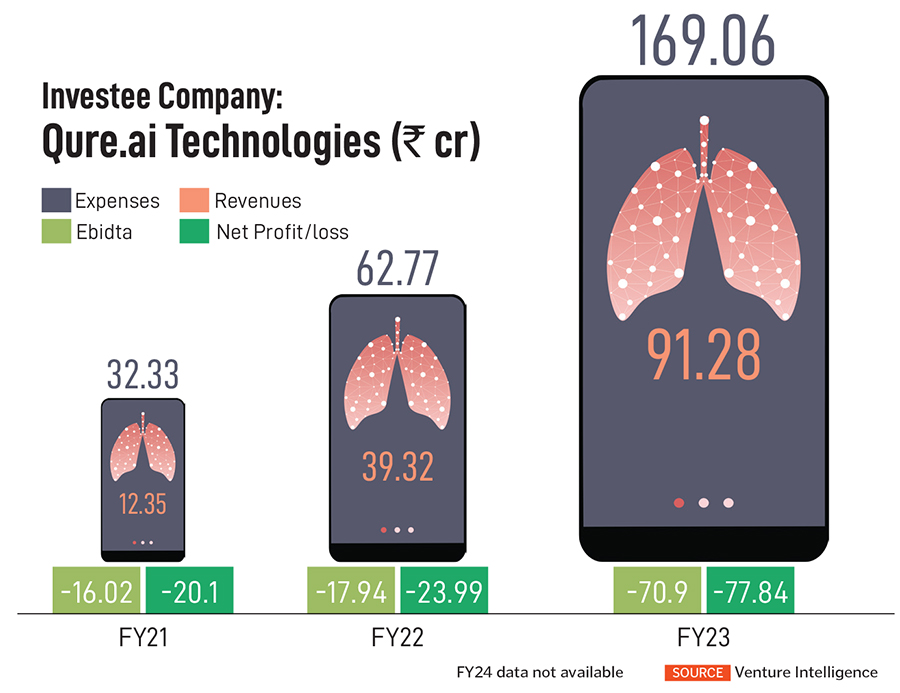

_RSS_Qure.ai’s income is from an annual, per hospital licence fee and also a per scan model fee (see financials table). Warier is now excited about building up their AI foundation model and investing into becoming a digital health product portfolio for lung cancer and TB. Qure.ai is headquartered in Mumbai, with regional offices in New York, London and Dubai.

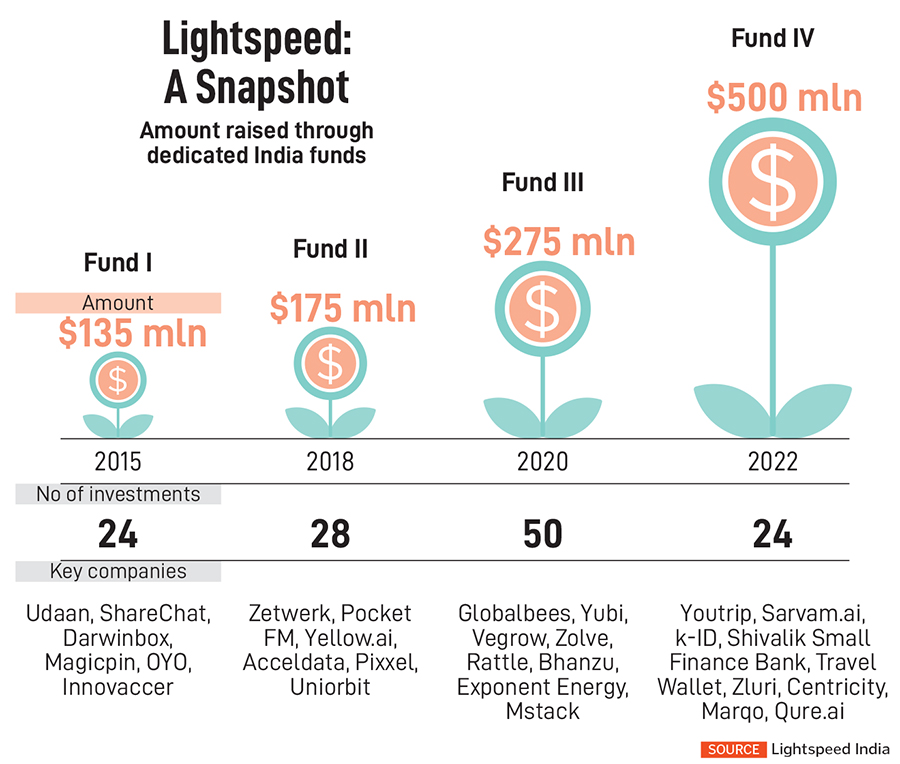

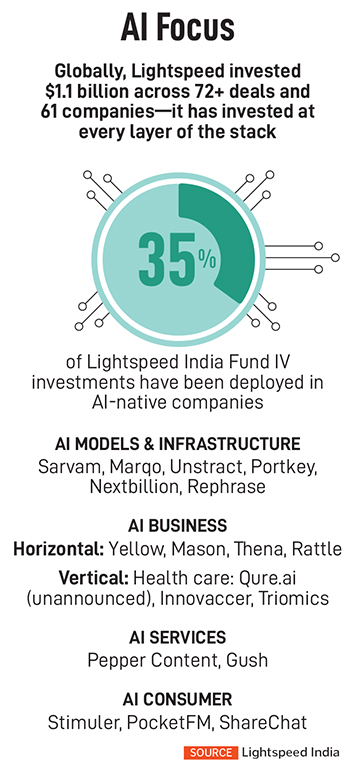

Reflective of the trend, Lightspeed has, globally and in India, doubled down in a major way focusing on generative AI and AI-backed startups. In the last 18 months, Lightspeed, globally, has invested $1.1 billion across 72 deals and 61 AI companies through all its funds.

Around 35 percent of Lightspeed India’s latest local fund (Fund IV) investments have been deployed in AI-native companies (see box).

In 2023, Lightspeed led a $41 million Series A funding into Sarvam.ai, along with Peak XV Partners and Khosla Ventures. Sarvam.ai has launched a full-stack generative AI platform, with multi-lingual, voice-enabled bots, which helps enterprises interact with customers better, in 10 local languages.

“Generative AI will change the way companies operate. This won’t happen overnight, as the underlying infrastructure and tooling required to enable companies to consume AI is yet to be built, but the impact and scope of change will be significant—across industries and functions,” says Lightspeed’s global partner Bejul Somaia. “We believe this is the start of a generational technology shift and that we will see a number of exciting companies emerge from India, building tools and applications to make the underlying AI infrastructure/models consumable.”

************

San Francisco-based Open AI, which made the ChatGPT chatbot and its rival Anthropic, are continuing to draw fresh funding in excess of billions of dollars, in a period when global VC funding was down from a year ago and is lowest in five years.

San Francisco-based Open AI, which made the ChatGPT chatbot and its rival Anthropic, are continuing to draw fresh funding in excess of billions of dollars, in a period when global VC funding was down from a year ago and is lowest in five years.

Seed funding was down by 30 percent, late-stage funding down by 37 percent and early-stage by 40 percent in 2023. Also, in the current year, AI-related companies have garnered 35 percent of US startup investment, according to Crunchbase data. Take AI out of the picture and these numbers would have looked uglier.

VC firms and startups have been bruised through the lengthy funding winter, rising geo-political tensions due to three wars, high rates of interest across economies and weakening demand for consumption. This has all meant a sharp cut in valuations in technology companies and delayed fund raising in recent months.

Tourist capital also vapourised and fundraising came in smaller rounds. Since 2023, VCs have realised it was not logical to keep pumping in fresh capital into business models which will be less likely to make money.

Also read: Sarvam AI: Building generative AI a billion Indians can use

Navigating some pain points

Lightspeed’s Somaia says that, in the early days, they were investing out of their early-stage $750 million fund vehicle across all geographies.

Somaia, who helped build India operations ground up in 2007-08, says things were starting to change by 2014, which would set the path for their first India fund a year later. India was seeing the initiation of 4G technology on mobiles, a deepening of the entrepreneurial pool and higher availability of risk capital for ambitious founders.

For India, funding came from several private investors towards startups such as Zomato, Flipkart, Delhivery, Ola and Freshdesk.

For India, funding came from several private investors towards startups such as Zomato, Flipkart, Delhivery, Ola and Freshdesk.

Lightspeed in India started off being an early stage investor, and, in recent years, has broadened its investing horizon in both directions, from pre-seed to pre-IPO investing.

It probably believes more in the Power Law principle where, assuming that even if a third of the companies invested in turn to junk value, five to 10 percent of the companies will make up for everything else.

“For businesses which demonstrate deep customer love, solid execution and operate in large market opportunities, we continue investing as the company grows. The risk-reward payoff changes as a company evolves and venture scale outcomes can be driven at multiple points of entry,” says Rahul Taneja, partner at Lightspeed India. Taneja, a one-time entrepreneur before joining Lightspeed in 2020, now focuses on consumer and commerce investments across India and Southeast Asia.

VCs look for a trendline shift before deciding on investment decisions. Lightspeed India sees a trendline change in the transition towards clean energy and the shift towards AI. “The last big platform shift was the introduction of mobile app stores, accompanied by access to affordable internet, and, prior to that, cloud computing. AI is the next big platform shift, which most certainly will impact everything about how we work, entertain, learn, shop and much more,” Taneja tells Forbes India.

In the VC space, Lightspeed is not a speed merchant. Neither does it compare to a single-rep power lifter (read: A hefty, late stage investment). Its investment decisions are well-thought-out and need to have a conviction. And when they bet, they bet big and deep.

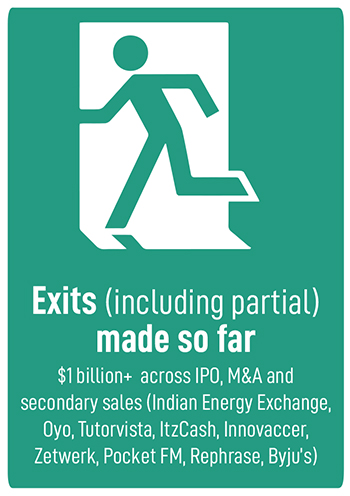

Since Lightspeed started investing in India, it has invested $2.1 billion, returned $1 billion to investors, with a value generated of $3.6 billion. The gross IRR (internal rate of return) to date is 35 percent, according to Somaia.

Consider some of Lightspeed India’s oldest investments which are still part of its portfolio and were made before the launch of its first dedicated India fund of $135 million in 2015 (see box). These include insurance tech firm One Assist (invested in 2011), OYO Rooms (invested in 2014) and Zomato-backed hyperlocal tech firm magicpin (invested in 2015).

Ritesh Agarwal, who founded budget hotel-chain venture OYO Rooms, has seen a rollercoaster ride in fortunes: From a rise to a unicorn status… its expansion to Southeast Asia and the Middle East, and the funding from SoftBank. The pandemic, however, derailed OYO’s journey as demand for rooms fell. And since then, its valuations have seen a steep fall.

Lightspeed is believed to have made handsome returns from a partial exit in OYO. Agarwal is believed to be raising funds privately from investors—for a now-profitable OYO—after shelving plans for an IPO. A Fitch Ratings note in May said it expects SoftBank-backed OYO’s Ebitda growth in FY25 to “be supported by both rising revenue and profitability as the result of a sustained reduction in costs”.

In the case of one-time most-valued edtech startup Byju’s, which now faces insolvency, Lightspeed India—which had a small investment in Byju’s—had managed to partially exit the firm in 2019. Lightspeed India declined to comment specifically about Byju’s functioning, but remains bullish about the opportunities in the edtech sector, particularly where the business model is a direct-to-consumer one.

Lightspeed India continues to bet on Bengaluru-based B2B commerce platform Udaan, despite the startup’s declining fortunes. Udaan’s FY23 revenue from operations fell 43 percent to Rs5,609 crore from Rs9,897 crore in FY22, according to regulatory filings, and while losses for FY23 narrowed a bit to Rs2,213 crore, it is still far away from its IPO plan. Venture Intelligence data shows Udaan’s valuation fell to $1.8 billion in a down round. The promoters have spoken about continuing to cut costs and boost revenues, but it is a rocky path ahead.

***********

We believe founders have to succeed before we, as investors, succeed. I have an interest in software and digital media, which I focussed on as a founder, as an investor in the previous venture firm as well as at Lightspeed. I invested in Slideshare in my previous firm, which was a digital startup that got acquired by LinkedIn,” says Lightspeed India partner Dev Khare.

Khare invested in HR SaaS startup Darwinbox in 2017, when no one believed in software sold to Indian companies and the Lightspeed team has backed several leading software companies, targeting the US and global markets.

Khare invested in HR SaaS startup Darwinbox in 2017, when no one believed in software sold to Indian companies and the Lightspeed team has backed several leading software companies, targeting the US and global markets.

With Gen AI, climate, deeptech, EVs and agritech being emerging focus areas for Lightspeed, the VC continues to focus on the core areas of consumer, enterprise/SaaS, cross-border commerce, small businesses and fintech. The theme of delivering to under-served India will also continue to play out.

While Somaia oversees all these segments, and particularly cross-border and late-stage deals, Khare and Hemant Mohapatra track Gen AI, enterprise/SaaS, while partner Shuvi Shrivastava focuses on fintech, edtech and BFSI. Another Lightspeed partner Pinn Lawjindakul focuses on the Southeast Asia region and its businesses.

As private capital allocation continues to move from China to other regions, India continues to benefit. Lightspeed has placed its focus on startups which are building ‘India for the World’, for exports. Lightspeed has invested in companies which are 100 percent export focussed, including Zetwerk, Zyod and MStack.

Somaia summarises the India startup ecosystem and its investment strategy. “Investors must approach India with a long-term, selective and conviction-driven mindset. It’s a tough market requiring patience, resilience, and adaptability to succeed,” he says.

Exponent: Driving the EV promise

As with generative AI, Lightspeed sees EVs as an emerging core sector. Exponent Energy, a B2B electric vehicles (EV) charging startup, has altered the landscape for EV mobility in Bengaluru by manufacturing battery packs, partnering with vehicle manufacturers, where the end-user buys the vehicle, battery pack and the charger.

India sold 16.7 lakh EVs in FY24, a 275 percent jump over the sales of 4.45 lakh EVs two years earlier, according to the Society of Manufacturers of Electric Vehicles. A majority, 38 percent sales, constitute e-3 wheelers, the segment which Exponent caters to.

Though EV sales are surging in India, the need to build the infrastructure, including charging stations, is the need of the hour. Where to charge the vehicle, how long will it take and will my battery last are factors influencing potential buyers and users of EVs, and is hurting quicker adoption.

Arun Vinayak, co-founder of Exponent Energy along with Sanjay Byalal Jagannath, focussed on building a battery management system (BMS) with a fast-charging platform. In India, unlike in the West, there is a crucial need for ultra-fast and smaller batteries (which save costs). This is mainly due to the absence of abundant charging stations.

Exponent has built 100 percent charging in 15 minutes on their network, which is much faster than industry standards. “The next fastest option is 1.5 hours and the industry average is four hours. Our USP is our BMS… when you charge, we ensure that every cell is managed well,” Vinayak, who was founding partner of Ather Energy, a two-wheeler EV maker, tells Forbes India.

Lightspeed is betting on the USP. Eight Roads Ventures, TDK Ventures, Lightspeed, YourNest VC, 3one4 Capital and others were part of the $26.4 million Series B fund raise in December 2023.

Exponent is among three companies in the world—besides Tesla and SCS Europe—to have built the technology of 1MW charging. Exponent plans for four 1MW charging stations in January 2025, along the Bengaluru-Hyderabad route, to help electrify buses.

Lightspeed and Exponent started talking to each other almost a year before the investment. “We continued to talk… but one day, they came to our lab and saw a vehicle charging,” Vinayak says. Harsha Kumar, who tracks EVs, climate tech and consumer tech at Lightspeed India, is on Exponent’s board.

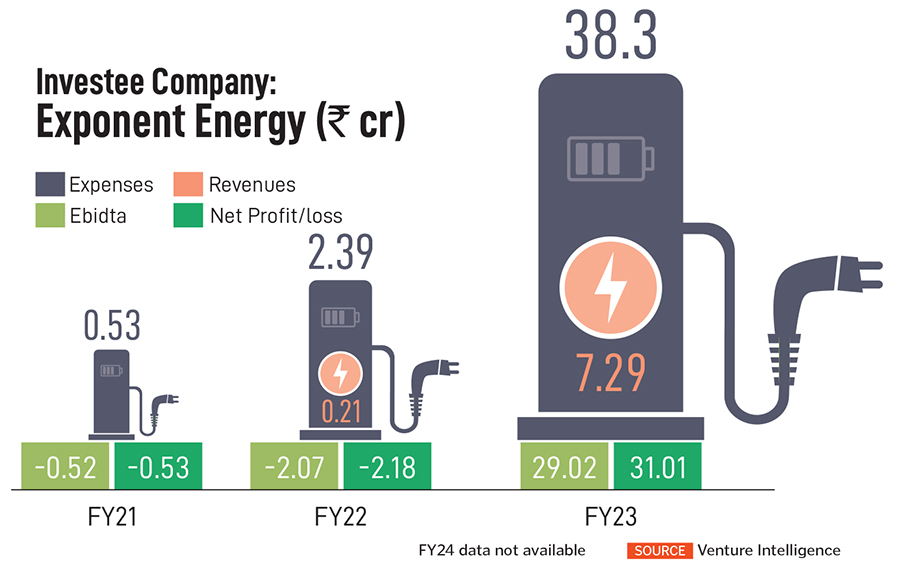

Exponent has got 1,800 vehicles orders and has delivered the first 700 in Bengaluru, servicing e-3 wheelers cargos, which will soon expand to passenger cars and intercity buses. Exponent (see earnings box) plans to expand to the top six cities in India by early 2025, including Delhi, Ahmedabad and Chennai.

AI: Is it too hyped up?

The usage of generative AI is acute, running the risk of being hyped up. The market for AI is expected to reach $7.8 billion by 2025 in India. AI will grow at a 20.2 percent CAGR, according to the State of the Education report 2022.

Gartner, in a June report titled ‘Hype Cycle for Artificial Intelligence’ says Gen AI has passed the peak of inflated expectations, although hype about it continues. “In 2024, more value will derive from projects based on other AI techniques, either stand-alone or in combination with Gen AI, that have standardised processes to aid implementation.”

Lightspeed spoke about the advantages of a hype cycle. “Founders will struggle if they’re asked to build a company in a non-hype cycle. Talent, sales and demand for one’s product is often sluggish in a non-hype cycle. I think hype cycles play a very critical role in really uncovering what’s what,” Mohapatra, partner at Lightspeed India, tells Forbes India. “If you’re really focussed on building a high-quality team, product, and business, and you stay focussed on solving real problems, you can do so many magical things,” adds Mohapatra, who tracks Lightspeed India’s Gen AI, SaaS portfolio, alongside Khare.

Qure.ai’s Warier started using AI before it became a buzzword. He agrees that AI companies have created cool technologies, “but building cool technologies does not mean that you can create commercial scale”.

Having also seen several rounds of funding already, Warier believes AI is “real” and there is enough medical data emerging from various sources, including smartwatches, scans, reports, doctor’s visits, which are giving experts a better understanding of the human body and diseases.

“Some hype may be getting built but the reality is that it will transform health care in the next 15 to 20 years,” Warier says.

The World Health Organization had, earlier this year, told health care workers to be aware about the risks of using AI, particularly in low- and middle-income countries.

The risk-reward ratio towards investing in Gen AI startups is high. But VCs want to be in a position where they are financing business models which will have profit pools, so, over a period of time, these will start making money. In the Gen AI space, the pools, at this stage, might emerge to be just a few, but they will be large and deep. Lightspeed’s leadership knows how to deal with these.